All About Paul B Insurance

Wiki Article

Unknown Facts About Paul B Insurance

Table of ContentsPaul B Insurance Can Be Fun For EveryoneThe smart Trick of Paul B Insurance That Nobody is Talking AboutExcitement About Paul B InsuranceThe Single Strategy To Use For Paul B InsuranceThe Definitive Guide for Paul B InsuranceThe Basic Principles Of Paul B Insurance

stands for the terms under which the claim will certainly be paid. With residence insurance coverage, for instance, you might have a substitute cost or real cash money worth policy. The basis of exactly how cases are cleared up makes a large influence on just how much you get paid. You ought to constantly ask just how claims are paid and also what the claims process will be.

The thought is that the cash paid out in claims in time will certainly be much less than the total premiums gathered. You might seem like you're tossing cash gone if you never ever submit a case, yet having item of mind that you're covered on the occasion that you do experience a significant loss, can be worth its weight in gold.

Rumored Buzz on Paul B Insurance

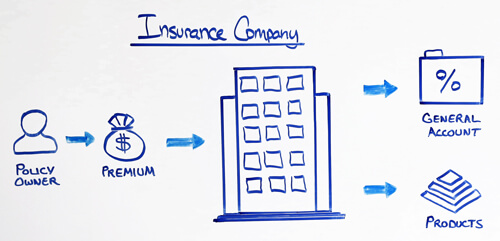

Visualize you pay $500 a year to guarantee your $200,000 house. You have ten years of paying, and also you have actually made no insurance claims. That comes out to $500 times 10 years. This suggests you have actually paid $5,000 for residence insurance. You begin to ask yourself why you are paying a lot for nothing.Since insurance policy is based on spreading the risk amongst many individuals, it is the pooled money of all people spending for it that enables the firm to develop properties as well as cover insurance claims when they take place. Insurance coverage is a service. It would certainly be good for the firms to simply leave prices at the exact same degree all the time, the reality is that they have to make sufficient money to cover all the possible cases their insurance holders might make.

Underwriting modifications and also rate increases or declines are based on outcomes the insurance coverage business had in past years. They sell insurance policy from only one firm.

Get This Report about Paul B Insurance

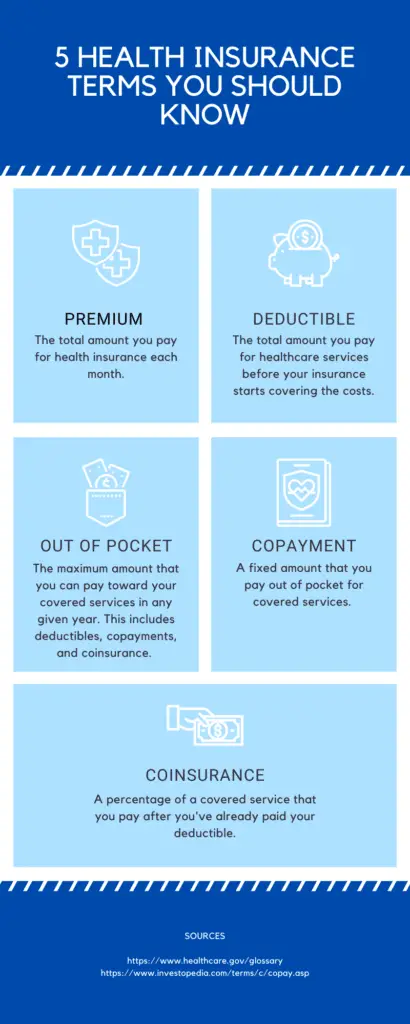

The frontline people you deal with when you acquire your insurance policy are the agents and brokers who represent the insurance firm. They a familiar with that company's products or offerings, yet can not speak towards other firms' plans, rates, or product offerings.They will have access to more than one firm and also should understand about the series of products used by all the companies they stand for. There are a navigate here few key inquiries you can ask on your own that may help you choose what type of insurance coverage you require. Exactly how much threat or loss of money can you think by yourself? Do you have the cash to cover your expenses or financial debts if you have a mishap? What concerning if your home or cars and truck is destroyed? Do you have the financial savings to cover you if you can't work due to a crash or ailment? Can you pay for greater deductibles in order to reduce your costs? Do you have unique demands in your life that call for additional insurance coverage? What worries you most? Plans can be tailored to your demands and determine what you are most concerned concerning safeguarding.

The insurance policy you need varies based on where you go to in your life, what kind of assets you have, as well as what your lengthy term goals as well as duties are. That's why it is essential to take the time to discuss what you desire out of your policy with your representative.

Paul B Insurance Can Be Fun For Everyone

If you take out a funding to buy an visit this web-site automobile, and afterwards something takes place to the vehicle, space insurance coverage will certainly pay off any type of portion of your finance that conventional vehicle insurance coverage doesn't cover. Some lenders require their borrowers to bring space insurance policy.The major objective of life insurance coverage is to provide cash for your beneficiaries when you die. Depending on the kind of plan you have, life insurance can cover: Natural fatalities.

Life insurance coverage covers the life of the guaranteed person. Term life insurance covers you for a duration of time chosen at acquisition, such as 10, 20 or 30 years.

Not known Incorrect Statements About Paul B Insurance

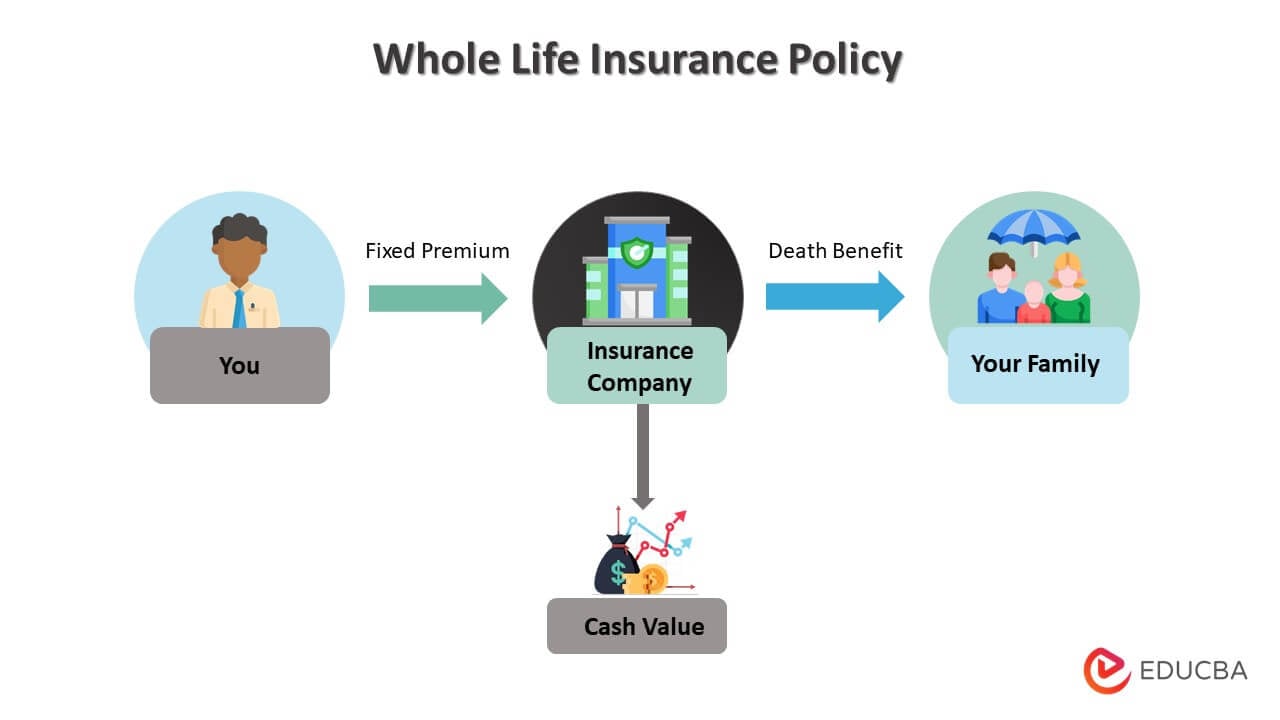

If you don't pass away throughout that time, no one earns money. Term life is preferred because it supplies large payouts at a lower expense than irreversible life. It likewise provides protection for an established variety of years. There are some variants of typical term life insurance coverage policies. Exchangeable plans enable you to transform them to irreversible life plans at a greater costs, permitting longer and potentially much more versatile protection.Permanent life insurance coverage policies build cash money worth as they age. The money value of whole life insurance policy plans grows at a set price, while the cash worth within universal policies can why not try these out rise and fall.

$500,000 of whole life protection for a healthy 30-year-old lady expenses around $4,015 annually, on average. That very same level of protection with a 20-year term life plan would certainly cost a standard of about $188 yearly, according to Quotacy, a broker agent company.

Not known Facts About Paul B Insurance

Report this wiki page